How Much Do US Tariff Hikes Really Cost? An iPhone Price Reveals All. Leave a comment

Image Source: pexels

The escalating cost of iPhones underscores the significant effect of canada us tariffs trudeau ford trump. Analysts predict that the entry-level iPhone 16, currently priced at $799, could surge to $1,142, marking an astonishing 43% increase. Likewise, the iPhone 16 Pro may see a price hike of $200-$300. Should Apple relocate manufacturing to the US, a $1,000 iPhone could soar to $3,500 in states such as New Jersey or Texas. Recent news indicates that these pricing changes could pose challenges to consumer affordability and reshape Apple’s global strategy. Social media is abuzz with discussions on how cordless power tool brands’ stock prices might respond to these economic developments.

Key Takeaways

- US tariffs can make iPhones much more expensive, up to 43%.

- iPhone costs depend on parts from countries hit by tariffs.

- Making iPhones in the US might not save money. Labour is costly, and tariffs on parts still apply.

- Sellers can avoid tariff effects by buying items early. This helps keep prices lower for customers.

- Watching for sales and discounts can help sellers save money. It also keeps their prices competitive.

- Buying used or older power tools is a cheaper option for shoppers.

- Knowing about trade rules helps sellers plan and avoid money problems.

- Tariffs raise iPhone prices and mess up global supply chains. This affects many industries, like power tools.

The Direct Impact of Tariff Hikes on iPhone Prices

Breakdown of iPhone Manufacturing Costs

Cost of components sourced from tariff-affected countries

The manufacturing cost of an iPhone is heavily influenced by the components sourced from various countries. For instance, the iPhone X had a manufacturing cost of approximately $370.25, with $197 attributed to materials and components. These components include advanced technologies like the TrueDepth sensing system and OLED displays, which are often imported from countries like China, South Korea, and Japan. The reliance on these tariff-affected nations significantly increases production costs when tariffs are imposed.

| Component | Cost (USD) |

|---|---|

| Cost of Materials/Components | $197 |

| Manufacturing | $15 |

| Other Direct Production Costs | $97 |

| Direct Overheads | $48 |

| Gross Profit per Unit | $367 |

| Operating Profit per Unit | $319 |

Assembly and testing costs in China

China remains the hub for iPhone assembly and testing due to its skilled workforce and established infrastructure. The cost of assembly and testing adds approximately $15 to the production of each iPhone. However, with the imposition of tariffs, the cost of exporting these assembled devices to the United States increases significantly. A 54% tariff rate could add nearly $297 to the cost of an iPhone, pushing the total production cost to $876.79.

Estimated Price Increases Due to Tariffs

Example: iPhone 16 Pro 256GB model

The iPhone 16 Pro 256GB model, priced at $1,100, exemplifies the impact of tariffs. Analysts estimate that the cost of producing this model, including hardware and assembly, is around $580. With a 54% tariff, the additional cost would raise the production expense to $876.79. This increase would likely result in a retail price hike, making the device less affordable for consumers.

Comparison of pre- and post-tariff costs

Before tariffs, the iPhone 16 Pro’s production cost stood at $580. After the imposition of a 54% tariff, the cost surged to $876.79, reflecting a 51% increase. This rise in production expenses forces companies like Apple to either absorb the cost or pass it on to consumers. For example, the iPhone 16 Pro Max, currently priced at $1,600, could see its retail price climb to $2,062, a 29% increase.

| Source | Estimated Price Increase | Current Price | New Price | Tariff Rate |

|---|---|---|---|---|

| NY Post | 45% | $580 | $850 | 54% |

| UBS | 29% | $1,600 | $2,062 | 54% |

| GSM Arena | 12% | $1,000 | $1,120 | 26% (India) |

Why Relocating Production May Not Lower Costs

Higher labour costs in the US

Relocating iPhone production to the United States would result in significantly higher labour costs. The U.S. lacks the skilled workforce available in China, and training new staff would require substantial investment. Additionally, operational costs in the U.S. are much higher, further increasing the overall production expense.

Lower labour costs in developing countries

Developing countries like India and Vietnam offer lower labour costs, making them attractive alternatives for manufacturing. However, these nations lack the established infrastructure and supply chain efficiency that China provides. Scaling operations in these regions would take years, delaying production and increasing costs.

Tariffs on imported components still apply

Even if production moves to the U.S., tariffs on imported components would still apply. Key parts like OLED displays and processors, sourced from countries like South Korea and Japan, would incur additional costs. This means that relocating production does not eliminate the financial burden of tariffs.

The impact of canada us tariffs trudeau ford trump extends beyond iPhones, affecting industries like power tools. Companies face similar challenges, including increased production costs and disrupted supply chains. These issues highlight the broader economic consequences of tariff policies.

Broader Economic Implications for CISIVIS

Impact on Power Tool’s Supply Chain

Disruption in sourcing components

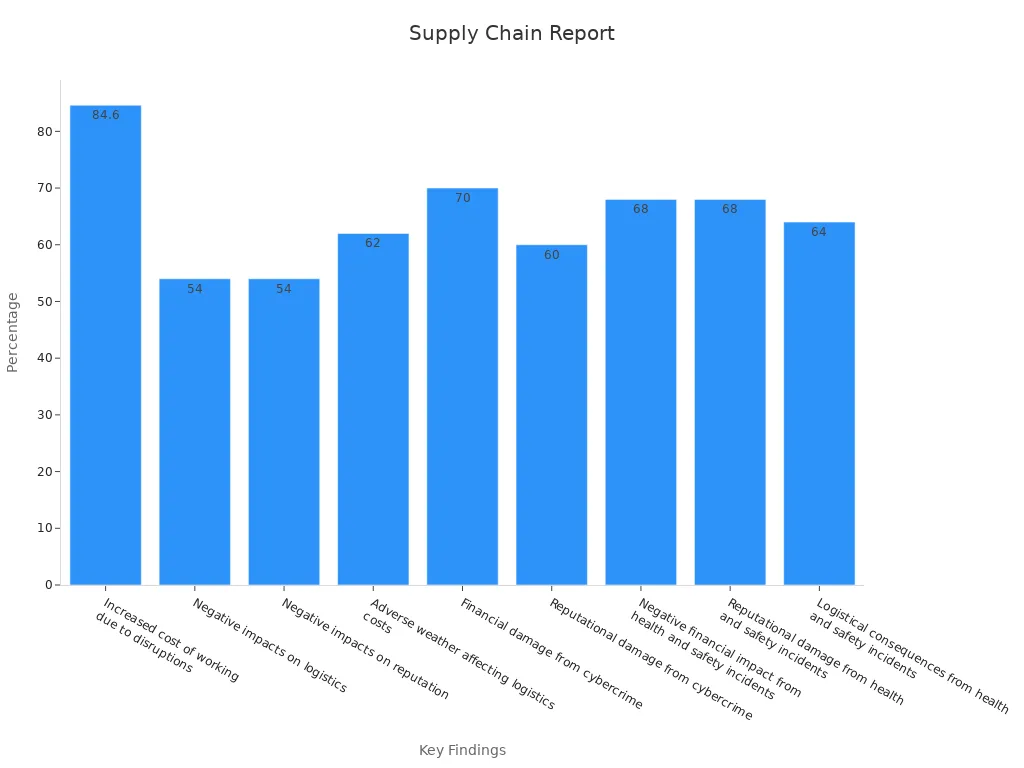

The imposition of tariffs has disrupted the global supply chain for power tool manufacturers like CISIVIS. Many components, such as high-performance motors and precision gears, are sourced from tariff-affected regions. These disruptions have led to increased costs and delays in production schedules. For example, logistical challenges caused by adverse weather conditions and health and safety incidents have further strained supply chains.

| Key Findings | Percentage |

|---|---|

| Increased cost of working due to disruptions | 84.6% |

| Adverse weather affecting logistics costs | 62% |

| Logistical consequences from health incidents | 64% |

To mitigate these challenges, companies are adopting strategies such as diversifying suppliers and transitioning to local sourcing. For instance, Tesla has secured multiple suppliers for critical materials like nickel, ensuring continuity in production despite global uncertainties.

Increased costs for logistics and assembly

Tariffs have also inflated logistics and assembly costs. Transporting components from tariff-affected countries now incurs higher fees, while assembly costs in alternative locations remain elevated. The reliance on end-to-end visibility in supply chains has become crucial for managing these rising expenses. Companies like GM have demonstrated the importance of engaging regionally diverse suppliers to reduce risks and maintain operational efficiency.

Effect on CISIVIS Power Tool’s Profit Margins

Annual losses due to tariff hikes

CISIVIS faces significant financial pressure due to tariff-induced cost increases. Higher expenses for raw materials, logistics, and assembly have eroded profit margins. Analysts estimate that annual losses could reach millions, impacting the company’s ability to invest in innovation and expansion. This financial strain underscores the broader economic consequences of tariff policies.

Potential impact on shareholder value

The ripple effects of these losses extend to shareholder value. Reduced profitability may lead to lower dividends and a decline in stock prices. Investors often react negatively to such developments, further compounding the financial challenges faced by companies like CISIVIS. Maintaining competitive pricing while absorbing increased costs remains a delicate balancing act.

Ripple Effects on the Tech Industry

Challenges faced by other tech companies like Dell and HP

The tech industry has not been immune to the effects of tariffs. Companies like Dell and HP have reported increased costs for essential components, such as processors and memory chips. The 25% tariff on steel imports has also raised construction costs for data centres, delaying project timelines and stretching budgets. These challenges highlight the interconnected nature of global supply chains.

Influence on global trade dynamics

Tariff policies have reshaped global trade dynamics, forcing companies to reconsider their sourcing and manufacturing strategies. Higher costs for electrical components have exacerbated grid congestion issues, further complicating energy access. These compounded effects illustrate the far-reaching implications of tariff hikes, not only for individual companies but also for the broader economy.

The impact of canada us tariffs trudeau ford trump serves as a stark reminder of the challenges posed by protectionist trade policies. Companies across industries must adapt to these changes to remain competitive in an increasingly complex global market.

Strategies Power Tools Brands Might Employ to Mitigate Tariff Costs

Absorbing Costs to Maintain Competitive Pricing

Impact on Power Tool’s profitability

Absorbing tariff-induced costs allows brands to maintain competitive pricing, but it significantly impacts profitability. For instance, raw material costs, which account for 40-55% of production expenses for electric impact drills, have risen sharply. In 2023, copper prices in Europe increased by 28%, forcing German manufacturers like Bosch to raise prices by 12-15%. However, they absorbed part of the costs through efficiency improvements. Similarly, U.S. tariffs on Chinese power tools led to a 7% price increase in the U.S. market. Companies like TTI mitigated these costs by shifting production to other regions. While these strategies help retain market share, they reduce profit margins, limiting resources for innovation and expansion.

Risks of reduced innovation budgets

Absorbing costs often results in reduced budgets for research and development (R&D). Innovation drives the power tool industry, with brands competing to offer advanced features and improved performance. A decline in R&D investment could hinder the development of new products, affecting long-term competitiveness. For example, Stanley Black & Decker reported annual tariff-related costs exceeding $300 million. By adjusting supply chains and increasing prices, they reduced this figure to under $100 million. However, such measures take 12 to 24 months to implement effectively, delaying innovation and potentially impacting consumer trust.

Relocating Production to Other Countries

Viability of moving production to India or Vietnam

Relocating production to countries like India or Vietnam offers lower labour costs and potential tariff avoidance. These nations provide a cost-effective alternative to China, with labour expenses significantly lower. However, the transition requires substantial investment in infrastructure and workforce training. For example, Japanese manufacturers faced procurement challenges due to a 15% yen depreciation, prompting them to explore alternative production sites. While India and Vietnam present viable options, scaling operations to match China’s efficiency remains a significant hurdle.

Challenges in scaling operations outside China

China’s established infrastructure and supply chain networks make it difficult for other countries to compete. Developing nations lack the logistical capabilities and skilled workforce required for large-scale production. Additionally, tariffs on imported components still apply, further complicating cost reduction efforts. For instance, the EU’s Carbon Border Adjustment Mechanism adds €12-18 per unit cost for non-compliant drills. This highlights the challenges of relocating production while maintaining cost efficiency and product quality.

Passing Costs to Consumers

How price increases could affect demand

Passing tariff costs to consumers often leads to higher retail prices, which can reduce demand. Regional market tolerance varies, with Indian consumers accepting only 5-6% price hikes despite rising raw material costs. In contrast, U.S. consumers have shown greater flexibility, with average power tool prices increasing by 7% due to tariffs. However, excessive price hikes risk alienating budget-conscious buyers, potentially driving them to competitors offering more affordable alternatives.

Potential backlash from loyal customers

Loyal customers may perceive price increases as a breach of trust, leading to dissatisfaction and reduced brand loyalty. For example, Mexico’s anti-dumping duty caused a 22% rise in production costs, prompting design changes to offset the impact. While these adjustments helped maintain competitive pricing, they also altered product features, affecting customer satisfaction. Brands must carefully balance cost recovery with customer retention to avoid long-term reputational damage.

The impact of canada us tariffs trudeau ford trump highlights the need for power tool brands to adopt innovative strategies. By absorbing costs, relocating production, or passing expenses to consumers, companies can navigate the challenges posed by tariffs while maintaining market competitiveness.

Practical Advice for Tools Distributor

Timing Your Product Purchase

Buying before tariff-induced price hikes

Distributors can mitigate the impact of tariffs by purchasing products before price increases take effect. Historical data highlights the benefits of this strategy. For instance:

- During the Smoot-Hawley Tariff Act (1930), businesses that stockpiled goods before tariffs avoided significant losses when global trade collapsed.

- In the 1980s U.S. tariffs on Japanese auto imports, companies that front-loaded imports gained a competitive edge.

- The Trump Tariffs (2018-Present) prompted retailers to increase imports, reducing the impact of higher input costs.

By anticipating tariff changes, distributors can secure inventory at lower costs, ensuring stable pricing for their customers.

Monitoring promotional offers and discounts

Promotional offers and discounts provide another opportunity to offset tariff-induced costs. Many manufacturers and suppliers introduce limited-time deals to maintain sales volumes during economic uncertainty. Distributors should monitor these offers closely to maximise savings. For example, power tool brands often provide bulk purchase discounts or seasonal promotions, which can help distributors maintain competitive pricing.

Tip: Use data analytics tools to track historical pricing trends and identify the best times to purchase inventory.

Considering Alternatives

Exploring refurbished or older Power Tool models

Refurbished or older power tool models offer cost-effective alternatives for distributors. These tools, typically priced 40-60% lower than new models, allow distributors to cater to budget-conscious customers. Refurbished tools undergo professional inspection and restoration, ensuring high performance and reliability. Additionally, they contribute to sustainability by reducing landfill waste.

Note: Distributors can highlight the environmental benefits of refurbished tools to attract eco-conscious consumers.

Evaluating competitor Power Tools

Exploring competitor brands can also help distributors manage costs. Brands with lower production expenses may offer tools at more affordable prices without compromising quality. For instance, some manufacturers relocate production to countries with lower labour costs, such as Vietnam or India, to reduce expenses. Distributors should evaluate these options to diversify their product offerings and remain competitive.

Staying Informed About Tariff Changes

Tracking news on trade policies

Staying updated on trade policies is crucial for distributors. Tools like ONESOURCE Free Trade Agreement Management provide real-time updates on tariff changes and their implications. This platform tracks FTA origin status, enhances compliance monitoring, and identifies cost-saving opportunities under specific trade agreements.

| Feature | Description |

|---|---|

| Tracking | Tracks and updates the FTA origin status of products. |

| Compliance | Enhances compliance monitoring with system-based document retention. |

| Cost Savings | Identifies opportunities to qualify goods under FTA-specific rules. |

Understanding how tariffs affect power tool products

Distributors must understand how tariffs influence the pricing and availability of power tools. Tariffs on imported components, such as motors and precision gears, can increase production costs. By analysing these impacts, distributors can adjust their strategies, such as diversifying suppliers or renegotiating contracts, to minimise financial strain.

Tip: Collaborate with manufacturers to gain insights into supply chain adjustments and potential cost-saving measures.

Contact CISIVIS

CISIVIS offers comprehensive support and services to distributors, retailers, and end-users. Their global presence and commitment to customer satisfaction make them a reliable partner in the power tools industry. For those seeking assistance or wishing to explore their extensive product range, contacting CISIVIS is straightforward.

📞 Customer Support Channels

CISIVIS provides multiple ways to connect with their team. Customers can choose the most convenient option based on their location and requirements:

- Phone Support: Reach out to their dedicated customer service team for immediate assistance. CISIVIS ensures prompt responses to queries related to products, orders, or technical issues.

- Email Assistance: Send detailed inquiries to their official email address. This method is ideal for complex questions or requests requiring documentation.

- Live Chat: Visit their website to access the live chat feature. This tool allows users to receive real-time support from knowledgeable representatives.

🌍 Regional Offices and Warehouses

CISIVIS operates regional offices and warehouses across the globe. These facilities ensure efficient distribution and localised support. Below is a summary of their key locations:

| Region | Address | Services Offered |

|---|---|---|

| United States | 4250 Shirley Avenue, California, US-91731 | Warehousing, Distribution, Support |

| United Kingdom | Unit-2 Prologis Park, Arenson Way, GB | Warehousing, Distribution |

| China | Building 12, Wanda Mansion, Wuhan, Hubei | Manufacturing, R&D, Customer Support |

Tip: Contact the nearest regional office for faster assistance and tailored solutions.

🛠️ Customisation and Consultation Services

CISIVIS specialises in customisation services for businesses. Their team collaborates with clients to design tools that meet specific needs. Services include:

- Logo and Packaging Design: Enhance brand visibility with personalised branding solutions.

- Tool Function Optimisation: Modify tools to suit unique operational requirements.

- Consultation Services: Receive expert advice on product selection, supply chain management, and market strategies.

📧 How to Get Started

To begin your journey with CISIVIS, visit their official website or contact their support team. Their user-friendly platform provides access to product catalogues, promotional offers, and technical resources. Customers can also subscribe to newsletters for updates on new products and industry trends.

Note: CISIVIS prioritises customer satisfaction by offering tailored solutions and reliable after-sales support. Their commitment to quality ensures a seamless experience for all clients.

The analysis reveals that US tariff hikes significantly increase iPhone prices, with models like the iPhone 16e projected to rise by 104%, reaching $1,222. Broader economic trends show a third of a percentage point increase in both the Producer Price Index (PPI) and Consumer Price Index (CPI), reflecting the wider impact of tariffs. These changes challenge Apple’s pricing strategies and disrupt global supply chains.

To navigate these price hikes, consumers can explore refurbished models, monitor promotional offers, or purchase before tariffs take effect. Staying informed about trade policies ensures better decision-making in an evolving market.

FAQ

What are tariffs, and how do they affect product prices?

Tariffs are taxes imposed on imported goods. They increase production costs for companies relying on foreign components. These higher costs often lead to price hikes for consumers, as businesses pass on the financial burden.

Why do companies like Apple rely on overseas manufacturing?

Overseas manufacturing offers lower labour costs and access to established supply chains. Countries like China provide skilled workers and infrastructure, enabling efficient production at reduced expenses compared to domestic alternatives.

How do tariffs impact global supply chains?

Tariffs disrupt supply chains by increasing costs for imported materials and components. Companies face delays and logistical challenges as they seek alternative suppliers or adjust production strategies to minimise expenses.

Can relocating production to other countries solve tariff issues?

Relocating production can reduce tariff exposure but introduces new challenges. Developing countries may lack infrastructure or skilled labour. Additionally, tariffs on imported components still apply, limiting cost savings.

How do power tool brands like CISIVIS manage tariff-related costs?

Brands adopt strategies such as diversifying suppliers, relocating production, or absorbing costs. Some pass expenses to consumers through price increases. Others focus on efficiency improvements to maintain profitability.

What can consumers do to avoid tariff-induced price hikes?

Consumers can purchase products before tariffs take effect, explore refurbished models, or monitor promotional offers. Staying informed about trade policies helps buyers make cost-effective decisions.

Do tariffs affect innovation in industries like technology and tools?

Yes, tariffs reduce profit margins, limiting funds for research and development. Companies may delay innovation to prioritise cost management, impacting the introduction of advanced features and new products.

How can distributors stay competitive during tariff hikes?

Distributors can diversify their product range, stockpile inventory before price increases, and negotiate better terms with suppliers. Monitoring market trends and trade policies ensures they adapt effectively to economic changes.

Tip: Staying proactive and informed helps businesses and consumers navigate the challenges posed by tariffs.