Avoid These 5 Mistakes as a Power Tools Distributor 2

Avoiding mistakes is crucial for success in the Power Tools Distributor industry. Errors in order fulfillment or customer service can result in financial setbacks and harm brand reputation. Key metrics, such as perfect order rate and picking accuracy, emphasize the importance of precision. Achieving a higher perfect order rate enhances customer satisfaction and encourages repeat business, while improved picking accuracy minimizes costly returns and complaints, directly boosting profitability. For power tools distributors, aligning operations with customer expectations and seeking other expert advise is vital for sustained growth and competitiveness. CONTACT CISIVIS for OEM/ODM solutions and customized strategies that deliver results, ensuring your business operates as efficiently and effectively as the same as retail standards.

Key Takeaways

- Work well with suppliers to keep enough stock and fair prices.

- Learn what customers want by asking them and studying the market.

- Manage inventory smartly to avoid having too much or too little.

- Advertise and create a strong brand to gain trust and stand out.

- Follow industry changes to stay competitive and find new chances.

- Use online tools to track inventory and connect with customers better.

- Talk openly with suppliers to work together and avoid problems.

- Check stock and customer likes often to improve product choices.

Mistake #1: Neglecting Supplier Relationships

Importance of Supplier Relationships for Power Tools Distributors

Impact on Inventory and Pricing

Strong supplier relationships are the backbone of a successful power tools distributor. Suppliers directly influence inventory availability and pricing strategies. Companies with robust partnerships often benefit from cost efficiency, as suppliers may offer competitive pricing or bulk discounts. Additionally, reliable suppliers ensure consistent inventory levels, reducing the risk of stockouts or overstocking.

📊 Key Factors in Supplier Relationships

Key Factors Description Collaboration Strong supplier relationships enhance collaboration, leading to better outcomes. Quality Improvement Effective management improves product quality. Cost Efficiency Strong relationships help in maintaining cost efficiency. Risk Management Good supplier relationships aid in managing risks effectively.

Consequences of Poor Communication

Poor communication with suppliers can lead to significant challenges. Misunderstandings about order specifications or delivery timelines may result in delays, stock discrepancies, or even financial losses. For power tools distributors, such issues can damage customer trust and tarnish brand reputation. Furthermore, weak communication limits opportunities for collaboration, hindering innovation and process improvements.

- Companies increasingly rely on suppliers for cost reduction and quality enhancement.

- Partnerships in the supply chain are essential for maintaining operational efficiency.

- Significant spending on materials highlights the growing dependence on suppliers.

Strategies to Strengthen Supplier Relationships

Regular Communication and Feedback

Establishing regular communication channels with suppliers fosters transparency and trust. Scheduling periodic meetings or check-ins allows distributors to address concerns, share feedback, and align on goals. Open dialogue also helps in identifying potential issues early, ensuring smoother operations. For instance, the North West London Procurement Services (NWLPS) implemented a Supplier Relationship Management (SRM) framework, which significantly improved supplier collaboration.

- 61% of Chief Procurement Officers prioritized supplier collaboration in 2023 (Deloitte, 2023).

- NWLPS developed an SRM Academy to enhance skills in managing supplier relationships.

Negotiating Win-Win Agreements

Negotiating agreements that benefit both parties strengthens partnerships. Distributors should focus on creating contracts that balance cost competitiveness with supplier profitability. Metrics such as on-time delivery rate, lead time, and order fill rate can guide these negotiations. By fostering mutual benefits, distributors can secure better terms while ensuring supplier satisfaction.

📈 Industry Metrics for Supplier Negotiations

Metric Description On-time delivery rate Measures the reliability of suppliers in meeting delivery schedules. Lead time Indicates the time taken from order placement to delivery. Order fill rate Reflects the percentage of customer orders that are fulfilled completely. Cost competitiveness Compares supplier pricing against market standards. Innovation capabilities Assesses the supplier’s ability to provide new or improved products/services.

Building strong supplier relationships is not just a strategy but a necessity for any power tools distributor aiming for long-term success. Effective communication and mutually beneficial agreements pave the way for operational excellence and market competitiveness.

Mistake #2: Failing to Understand Customer Needs

Why Customer Insights Matter for Power Tools Distributors

Misaligned Products and Lost Sales

Understanding customer needs is essential for power tools distributors to align their product offerings with market demand. Misinterpreting these needs often leads to mismatched products, resulting in lost sales and dissatisfied customers. For instance, distributors who fail to provide user-friendly tools or neglect safety education may inadvertently contribute to accidents or inefficient tool usage. Additionally, misinformation about market trends can hinder growth, emphasizing the importance of accurate customer insights.

💡 Tip: Regularly validate assumptions about customer preferences through pilot programs or minimum viable products. This approach reduces the risk of product failures and ensures alignment with market demand.

Leveraging Customer Feedback for Better Product Selection

Customer feedback serves as a valuable resource for refining product selection. Surveys and reviews reveal insights into customer demographics, preferences, and behaviors. Distributors can use this data to identify gaps in their inventory or improve existing offerings. For example, data analytics platforms transform large datasets into actionable insights, highlighting areas where products may not meet expectations or where new opportunities exist. By leveraging feedback, distributors maintain a competitive edge and enhance customer satisfaction.

Methods to Understand Customer Needs

Conducting Market Research

Market research provides a structured approach to understanding customer needs. Online surveys allow distributors to gather data from a broad audience quickly, customizing questions to target specific insights. Focus groups offer qualitative feedback, enabling distributors to test product concepts and understand customer attitudes. Social media monitoring tracks customer conversations and sentiments, offering real-time insights into preferences and complaints.

📊 Market Research Techniques

- Online Surveys: Efficient for collecting data from a large customer base.

- Focus Groups: Ideal for gaining in-depth qualitative feedback.

- Social Media Monitoring: Useful for tracking customer sentiments and identifying trends.

Using Customer Data and Analytics

Data analytics tools empower distributors to analyze customer behavior and preferences effectively. These platforms identify patterns in purchasing habits, helping distributors tailor their inventory to meet demand. For example, analytics can reveal which products are most popular among specific demographics or highlight seasonal trends. By utilizing these insights, distributors optimize their product offerings and marketing strategies, ensuring they meet customer expectations.

🔍 Note: Around 50% of startups fail due to misreading market demand. Power tools distributors can avoid this pitfall by investing in robust data analytics solutions to validate customer needs.

Accurately understanding customer needs is a cornerstone of success for power tools distributors. By leveraging market research and data analytics, distributors can align their operations with customer expectations, reduce risks, and drive growth.

Mistake #3: Overlooking Inventory Management

Inventory Challenges Faced by Power Tools Distributors

Financial Risks of Overstocking

Overstocking ties up working capital and increases carrying costs, which can range from 20% to 40% of the inventory’s total value annually. This financial burden often results in reduced cash flow, limiting a distributor’s ability to invest in other growth opportunities. Furthermore, excess inventory risks obsolescence, damage, or price reductions, leading to annual write-downs of 3% to 5%. For a power tools distributor, these losses can significantly impact profitability and operational efficiency.

📊 Inventory Management Statistics

Evidence Type Statistic Carrying Costs Average business holds 25-35% of working capital in inventory, with storage and handling costs at 20-40% of total value annually. Overstocking & Write-downs Holding excess inventory can result in 3-5% annual write-downs due to obsolescence, damage, or price changes.

Lost Opportunities Due to Stockouts

Stockouts not only lead to immediate revenue losses, which can average 4% per incident, but also damage customer trust. In some industries, these losses can climb as high as 14%. For power tools distributors, stockouts can cause customer churn rates of up to 67%, negatively affecting brand reputation and future sales. Poor inventory management also results in operational inefficiencies, wasting time and resources that could be better allocated elsewhere.

Effective Inventory Management Practices

Implementing Inventory Management Software

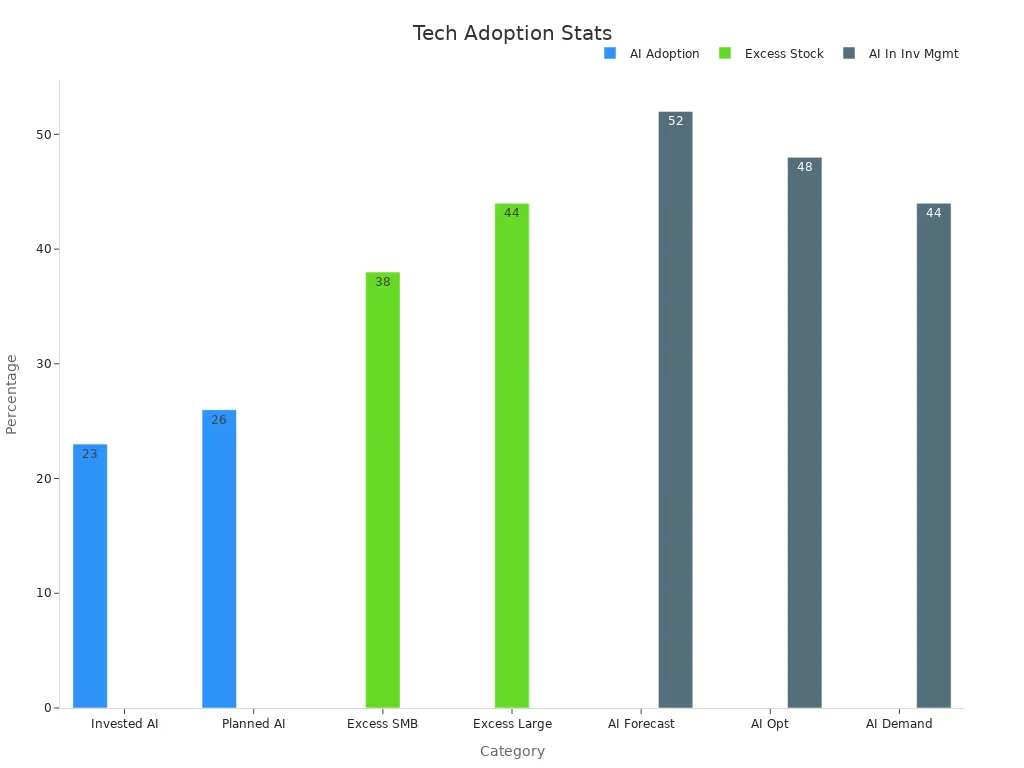

Inventory management software automates tracking and forecasting, reducing human error and improving accuracy. Manual processes often lead to inaccuracies of 30% to 50%, increasing costs and missed sales opportunities. By adopting technology like RFID tags or AI-driven systems, distributors can optimize inventory levels and streamline operations. For example, AI tools assist in demand planning, inventory optimization, and forecasting, ensuring distributors maintain the right stock levels.

Regular Stock Reviews and Trend Analysis

Regular stock reviews help distributors identify slow-moving items and adjust purchasing strategies accordingly. Trend analysis provides insights into seasonal demand, enabling better forecasting and reducing the risk of overstocking or stockouts. Distributors who allocate resources based on customer profitability often achieve better financial returns. For instance, focusing on high-value “A” customers rather than low-value “C” customers ensures inventory dollars are spent wisely.

📋 Key Benefits of Regular Stock Reviews

- Identifies slow-moving inventory to reduce carrying costs.

- Improves demand forecasting through trend analysis.

- Enhances resource allocation by prioritizing high-value customers.

Example

A power tools distributor implemented RFID technology to improve inventory accuracy, which had previously been at 63%. This change reduced stockouts and overstocking, leading to a 15% increase in customer satisfaction. Additionally, the distributor adopted AI-driven forecasting tools, which optimized inventory levels and reduced carrying costs by 20%. These practices not only improved operational efficiency but also enhanced the distributor’s market competitiveness.

Mistake #4: Ignoring Marketing and Branding

Marketing and Branding Essentials for Power Tools Distributors

Building Trust and Credibility

Trust and credibility are the cornerstones of a successful power tools distributor. Customers are more likely to purchase from brands they perceive as reliable and authentic. User-generated content (UGC), such as reviews and testimonials, plays a pivotal role in building this trust. Studies reveal that UGC is 2.4 times more authentic than branded content, and 90% of consumers prioritize authenticity when choosing brands. By encouraging customers to share their experiences, distributors can create a sense of community and foster loyalty.

“By harnessing content from its own consumers, the company creates a deeper bond with them, with the most brand loyal acting as ambassadors for the brand on its own social media sites.”

Differentiating in a Competitive Market

The power tools market is highly competitive, with numerous players vying for customer attention. To stand out, distributors must highlight their unique value propositions. Whether it’s offering innovative products, exceptional customer service, or competitive pricing, differentiation is key. Challenges such as designing ergonomic tools and adhering to stringent safety standards further emphasize the need for a strong brand identity. A well-defined brand not only attracts customers but also positions the distributor as a leader in the industry.

| Category | Details |

|---|---|

| Drivers | Increasing construction activities, thriving automotive sector, rising preference for battery-powered tools |

| Restraints | High maintenance costs, fluctuating raw material prices |

| Opportunities | Development of smart tools, growing demand from residential consumers |

| Challenges | Designing ergonomic tools, meeting safety standards |

Proven Marketing and Branding Strategies

Utilizing Digital Marketing Platforms

Digital marketing platforms offer unparalleled opportunities to reach a broader audience. Social media channels like Instagram, YouTube, and TikTok are particularly effective for showcasing products through engaging video content. Influencer marketing has also gained traction, enabling brands to connect authentically with niche markets. The global digital advertising market is projected to grow significantly, with an estimated size of USD 488.4 million in 2024. By leveraging these platforms, distributors can enhance visibility and drive customer engagement.

- Video advertising resonates with consumers, making platforms like YouTube essential.

- Influencer marketing builds trust and expands brand reach.

- AI-driven tools improve targeted advertising and customer journey management.

Developing a Strong Brand Identity

A strong brand identity sets a distributor apart from competitors. This involves consistent messaging, visually appealing packaging, and a clear mission statement. Investing in local marketing and direct-to-consumer (DTC) strategies can further strengthen brand presence. For example, companies like STIHL and Kohler have successfully implemented digital advertising and local marketing initiatives, resulting in significant revenue growth.

| Company | Strategy | Results |

|---|---|---|

| STIHL | Buy Online, Pick Up in Store | 399% YoY increase in online revenue |

| Kohler | Digital advertising | 80% increase in sales leads |

| Kubota | PowerChord platform | 24% increase in leads, 89% decrease in CPC |

| FLOE | Local marketing | 25% increase in sales revenue |

Example

A leading power tools distributor expanded its digital footprint by launching a direct-to-consumer website. This initiative increased visibility and provided valuable insights into customer preferences. The distributor also partnered with regional retailers to address local market demands effectively. These strategies not only boosted sales but also enhanced customer loyalty, demonstrating the power of targeted marketing and branding efforts.

Mistake #5: Failing to Adapt to Industry Trends

Risks of Stagnation for Power Tools Distributors

Losing Market Share to Competitors

Failing to adapt to industry trends can lead to significant losses in market share. The tools and machines market has shown minimal growth due to stagnation caused by slow adoption of new technologies and a lack of innovation. Competitors who embrace advancements, such as energy-efficient tools and smart technology, are gaining an edge. Additionally, consumer preferences are shifting toward sustainable and eco-friendly products. Distributors who fail to meet these demands risk losing relevance in a competitive landscape.

- The tools and machines market is experiencing slow growth due to limited innovation.

- Consumer demand for sustainable and energy-efficient tools is rising.

- Competitors are capitalizing on these trends to capture market share.

Missing Growth Opportunities

Stagnation also results in missed opportunities for growth. Emerging trends, such as AI-driven tools and renewable energy-powered equipment, present avenues for expansion. Distributors who fail to explore these innovations may struggle to attract new customers or retain existing ones. Moreover, the growing emphasis on sustainability offers a chance to align with global initiatives, enhancing brand reputation and opening doors to new markets.

Staying Ahead of Industry Trends

Participating in Trade Shows and Networking Events

Trade shows and networking events provide valuable opportunities to stay informed about industry developments. These platforms showcase the latest innovations and foster connections with industry leaders. Sustainability initiatives are becoming a priority, with 60% of event planners including sustainability requirements in their proposals. Educational experiences at these events also allow distributors to engage with relevant content, ensuring they remain competitive. By attending such events, distributors can identify emerging trends and adapt their strategies accordingly.

- Trade shows highlight cutting-edge technologies and foster industry connections.

- Sustainability is a growing focus, with planners prioritizing eco-friendly practices.

- Educational sessions at events provide insights into market demands.

Investing in Training and Development

Investing in employee training ensures that teams remain equipped to handle industry changes. Companies like Schneider Electric have demonstrated the benefits of internal talent development, which improves employee satisfaction and retention. Similarly, Bitwise Inc. has attracted talent by offering training programs that eliminate traditional degree requirements. For power tools distributors, these strategies enhance workforce capabilities, enabling them to adopt new technologies and meet evolving customer needs.

- Training programs improve employee skills and satisfaction.

- Internal talent marketplaces help retain top performers.

- Development initiatives prepare teams for technological advancements.

Example

A leading power tools distributor successfully adapted to industry trends by investing in AI-driven inventory management systems. This innovation reduced operational inefficiencies and improved customer satisfaction. The company also participated in international trade shows, where it showcased its eco-friendly product line. These efforts not only increased market share but also positioned the distributor as a forward-thinking industry leader.

Avoiding common pitfalls is essential for any power tools distributor aiming for long-term success. Key mistakes, such as neglecting supplier relationships or failing to understand customer needs, can lead to significant losses. Proactive measures, like leveraging digital tools for inventory control and carving a profitable niche, ensure operational efficiency and market differentiation.

📋 Summary of Mistakes and Remedies

Key Mistakes Remedies Losing up to 37% of profits Identify and rectify critical mistakes Inability to tap new markets Rethink sales growth strategy Losing control over inventory Leverage digital tools effectively Failing to differentiate in the market Carve a profitable niche Misunderstanding Price vs. Service Recalibrate sales strategies

Success demands continuous improvement and strategic planning. By implementing these solutions, distributors can enhance profitability, build customer trust, and secure a competitive edge in the industry.

FAQ

What are the key qualities of a successful power tools distributor?

Successful distributors prioritize strong supplier relationships, understand customer needs, and maintain efficient inventory management. They also invest in marketing, branding, and staying updated on industry trends. These qualities ensure operational efficiency, customer satisfaction, and long-term growth.

How can distributors improve supplier relationships?

Distributors can improve supplier relationships by maintaining regular communication, providing constructive feedback, and negotiating mutually beneficial agreements. Building trust and fostering collaboration with suppliers ensures better pricing, consistent inventory, and reduced risks.

Why is inventory management critical for power tools distributors?

Effective inventory management prevents overstocking and stockouts, which can lead to financial losses and customer dissatisfaction. By using inventory management software and conducting regular stock reviews, distributors can optimize stock levels and improve operational efficiency.

How can distributors differentiate themselves in a competitive market?

Distributors can stand out by offering innovative products, exceptional customer service, and competitive pricing. Developing a strong brand identity and leveraging digital marketing platforms also help attract customers and build trust.

What role does customer feedback play in product selection?

Customer feedback provides valuable insights into preferences and market demand. Distributors can use this data to refine their product offerings, address gaps in inventory, and ensure alignment with customer expectations.

How can power tools distributors stay ahead of industry trends?

Distributors can stay ahead by attending trade shows, networking events, and investing in employee training. Keeping up with advancements like AI-driven tools and sustainable products ensures competitiveness and relevance in the market.

What are the risks of ignoring marketing and branding?

Ignoring marketing and branding can lead to reduced visibility, customer trust, and market share. A strong brand identity and effective marketing strategies help distributors build credibility, attract customers, and differentiate themselves from competitors.

How does CISIVIS support power tools distributors?

CISIVIS offers OEM/ODM solutions, customized strategies, and a wide range of high-quality tools. With advanced R&D capabilities, global manufacturing facilities, and competitive pricing, CISIVIS helps distributors achieve operational excellence and market success.

I as well as my buddies have been viewing the nice key points found on the website and then came up with an awful feeling I had not expressed respect to the web site owner for those techniques. Most of the people came certainly very interested to read through all of them and already have pretty much been taking pleasure in these things. I appreciate you for turning out to be really helpful and also for selecting certain remarkable topics millions of individuals are really needing to understand about. Our own sincere regret for not saying thanks to earlier.